Are you seeking the best dental insurance in the UK? While the NHS offers basic coverage, private dental insurance companies can provide additional benefits which are more affordable than you think.

In this guide we will delve into the differences between NHS and Private Dental insurance, covering the various levels of protection available and comparing the top dental insurance providers in the UK for 2024.

By the end of this article, you will have all of the information you need to help you make your decision on the best dental insurance to suit your needs.

Save the trip to your NHS dentist and speak to a certified dentist right now online. Visit JustAnswer to chat online with a qualified dentist and find out all the information you need – without having to take time out for a dental appointment.

Their dentists are based in the US and are available 24/7 to help you out!

In This Article

- 1 Do Brits really need private dental insurance?

- 2 Types of dental Insurance in the UK

- 3 Dental plan comparison: NHS Vs private dental plans in the UK

- 4 Providers of dental plans in the UK

- 5 Best dental insurance in the UK – comparison tables

- 6 Tips for getting the best price on dental insurance

- 7 Chat with a dentist

- 8 FAQ’s

Do Brits really need private dental insurance?

Unlike some other developed countries, we have a healthcare system which offers subsidised dental care to all residents. But whereas seeing an NHS doctor is free, most adults still have to pay to visit an NHS dentist.

There are four main reasons why you might opt for private dental cover:

- You don’t live near an NHS dentist or can’t find one that’s accepting new patients

- You have had a bad experience with an NHS dentist and would prefer the extra level of care from a private dentist

- Your preferred treatment isn’t available on the NHS (for example white fillings or Invisible aligner braces)

- Your teeth are in bad condition and frequently require treatment

If your teeth are in great condition and you rarely need treatment, there may be no financial argument for personal dental insurance. However, it will still offer peace of mind if your teeth deteriorate or you need emergency treatment, for example for an oral abscess.

NHS dental charges

Let’s first be clear about what NHS dental treatment costs if you use the NHS, as this will then help you work out how much it’s worth paying for a private dental plan in the UK.

In England and Wales, charges are banded according to the treatment you receive. The following charges apply for 2019/20:

Charge Band | Charge | Treatments Included |

In England | ||

Band 1 | £23.80 | Examination, diagnosis and advice. X-rays and scale & polish included if needed. Any emergency treatment. |

Band 2 | £65.20 | Fillings, root canals and tooth extractions. |

Band 3 | £282.80 | Crowns, dentures, bridges and other complex treatment. Braces may be included if needed for medical reasons but cosmetic treatment is not covered. |

In Wales | ||

Band 1 | £14.70 | Examination, diagnosis and advice. X-rays and basic scale & polish included if needed. Any emergency treatment. |

Band 2 | £47.00 | Advanced scale & polish. Fillings, root canals, tooth extractions, and other oral surgery. |

Band 3 | £203.00 | Crowns, dentures, bridges and other complex treatment. Orthodontic treatment and custom-made appliances like sports guards. |

Each band includes the treatments covered by lower bands, and only one charge is applied for each treatment. So if you need an x-ray and two fillings, for example, you will just pay the band 2 charge once. If you come back in another month or two for unrelated treatment, you will have to pay again. This is why it may work out cheaper – or comparable in cost – to visit a private dentist using your insurance.

In Scotland and Northern Ireland there are fixed charges based on the work carried out, but they are still subsidised and capped.

Free dental care is provided for under-18s; those aged 18 and in full-time education; and pregnant and nursing mothers.

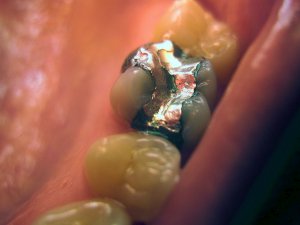

Note that NHS treatment only provides amalgam fillings, which are grey or silver in appearance, unless it’s on a visible front tooth . If you would like a white composite filling you will need to pay for private treatment – but dental health insurance can help with the cost of this.

Orthodontic braces are available on the NHS to teenagers and some adults, but the only choice will be traditional metal braces. Less noticeable styles, such as lingual braces, are only available privately. Our guide to braces for adults has some approximate prices for private orthodontic treatment.

Trouble finding an NHS dentist

It’s no secret that finding an NHS dentist in some parts of the country is hard work, as this Channel 4 piece shows.

People may end up travelling miles out of their way to find a dentist who will accept them. In other cases, it’s just impossible and the only option is to visit a private dentist and pay for treatment yourself (either directly or via an insurance plan).

Dentists very often carry out some work for the NHS as well as treating patients privately. If your nearest dentist isn’t accepting any new patients on the NHS they may still be able to offer private treatment, therefore having the best dental insurance plan to cover these charges would be of great benefit.

Types of dental Insurance in the UK

Whichever type of dental treatment you receive, insurance can help lower the cost and make payments more affordable. There are several ways to go about getting cover for dental work.

Private or NHS dental insurance

The most common approach is to get traditional dental insurance. You pay a monthly or annual premium to your insurer, and they reimburse you for some or all of your dental costs.

You can get cover for NHS treatment only, or for private care as well. The amount reimbursed will depend on your policy terms and the type of treatment you need. We have a lot more information below about what to consider when choosing dental insurance for you and your family.

Health insurance with dental cover

Another way to get insurance cover for dental procedures is to take out health insurance that includes dental cover. Most insurers allow you to add dental cover onto your private health insurance for a small amount extra. If you already have health insurance, contact your provider to discuss your options.

Capitation plans

Capitation plans are another way to spread the cost of dental care. The difference with this type of insurance is that your monthly payments go directly to your dentist (although they may be handled by a third party like Denplan).

Different levels of capitation plans cover can include some or all of the following:

- Basic maintenance (checkups and cleaning)

- Simple treatments (fillings and extractions)

- Complex treatments (root canals, dentures, crowns, etc.)

- Emergency dental cover

Your dentist will discuss the available choices and determine the monthly fee, typically following an evaluation of your current dental condition. The fee may fluctuate based on factors such as your age, the state of your teeth, and the coverage plan you select.

While payments are generally set annually, they can be adjusted annually based on the above criteria. Additionally, a registration fee may be required upon your initial enrolment.

Pros and cons of capitation plans

Capitation plans are a good way to spread the cost of your dental health care, especially if you know you’re likely to need regular trips to the dentist. You know in advance how much you’ll have to pay each month and there is no extra charge when you have a treatment that is covered by your plan.

The downside of capitation plans compared to dental insurance plans is they are linked to one particular dental practice; fine if your filling falls out at home but not so handy if you happen to be away at the time. However, this needn’t be a problem if you have emergency cover – just check your plan terms carefully.

Dental plan comparison: NHS Vs private dental plans in the UK

Each insurance provider offers different levels of dental cover, and the things included vary from one provider to another.

Not all insurance plans cover every aspect of dental care. Below are some things you’ll need to consider when selecting a dental care plan. Think carefully about which ones you need as this will help you narrow down your options and get a better idea of prices.

Routine NHS treatments

Regular checkups and a scale and polish with an NHS dentist should be covered by all plans to some extent.

Fillings, extractions, crowns and bridges

Dental procedures and surgery may only be included in some policies, or the insurer may only pay out a certain percentage of the total cost.

Emergencies and accidents

Out-of-hours dental care comes at a premium so it can be good to have insurance that will cover you if you need to see a dentist in an emergency.

An ‘accident’ is usually classed as an incident that causes you to need urgent attention, for example a fall. An ’emergency’ is a situation in which you need urgent attention, usually for toothache pain relief.

The Boots plan, for instance, defines emergency treatment as “Dental treatment required for the immediate relief of severe pain, trauma, swelling or haemorrhage”.

Cosmetic dentistry

It’s unlikely that your standard policy will cover cosmetic dentistry such as veneers, braces, teeth whitening or implants – unless it’s part of a course of NHS treatment. Some insurers cover private cosmetic work in their most expensive policies.

Dental implants

If you’re looking for dental insurance for implants, you may be able to purchase separate or premium cover from your insurer.

Dental implants cost £2,300 per tooth on average, making this the most expensive kind of dental treatment. For this reason, implants are usually not included with standard policies. Dental implant insurance will still only cover you for teeth lost due to accidents and perhaps natural loss; not purely cosmetic work.

Oral cancer

Many policies include cover for oral cancer and this might be paid as a fixed lump sum rather than you claiming for your actual costs.

Hospital stays

If you need to spend time in hospital as a result of your treatment, how much will your insurer pay out per day?

Worldwide cover

Do you want to be covered for emergency dental treatment if something happens while you’re overseas? This might already be covered by your travel insurance policy, but if you travel a lot it’s something to look out for.

Pre-existing conditions

Check whether your insurer will cover pre-existing conditions (and how they define these) or work related to incidents that happened before the policy began. For example, if you need extensive treatment following a car accident, you probably won’t be able to take out an insurance policy after the event and use it to claim for that treatment.

Your insurer may require you to have had a checkup in the last 12 months; otherwise they may class any treatment identified at your first checkup as ‘pre-existing’ and refuse to pay for it.

Full or partial payment and excesses

Will your insurer pay the full cost of your work or do they reimburse you for a fixed percentage? Are there any fixed excesses to pay? Check the small print to avoid any nasty surprises. Even if you only have to pay for 50% or 25% of your treatment, this can still add up to hundreds of pounds a year.

Annual limits

Insurers usually put annual limits on the amount you can claim for each category of cover, for example £150 for checkups or £1,000 for emergency treatment.

Cover for family members / children

Although under-18s receive free dental care on the NHS, you may want your children to receive private treatment instead.

Some policies may automatically cover children up to a certain age; with others you’ll need to purchase special family cover or pay extra to insure your children.

Waiting periods

In many cases your full dental coverage won’t kick in until you’ve held your policy for 1-4 months. You may get immediate cover for regular checkups and perhaps some minor treatments, but claims for more complex procedures won’t be allowed until the specified period has passed. You can expect to pay higher premiums for dental insurance with no waiting period.

When you have to pay

Most insurance providers will require you to pay the bill up-front and will then reimburse you for all or a percentage of the cost. Some may settle the bill directly with your dentist, so this is worth investigating.

Policy cancellation

What if you change your mind about your policy and want a refund? You never know when your circumstances might change, so it’s worth knowing how far into your policy you’re allowed to cancel and request a refund, if at all.

Providers of dental plans in the UK

Now that you understand why it can be beneficial to get insured, let’s take a look at some of the largest dental insurers in the UK.

Bupa

Bupa is one of the biggest names in private health cover in the UK and offers three levels of private dental health insurance. They don’t advertise their prices online so you’ll need to contact them directly to request a quotation.

Bupa have their own dental clinics across the UK and they also work with a network of approved private dentists. Using one of Bupa’s own clinics means your claim can be settled without the usual paperwork and claim forms.

AXA

Another name you’ve probably heard before (since it’s one of the biggest insurance companies in the world), is AXA. The company itself is around 30 years old but its roots date back to the 18th Century.

AXA dental insurance offers two levels of cover, for NHS and private treatment. They won’t ask about your medical history or require you to have a checkup before joining, and they offer a no claims discount of up to 35% (claims for checkups, cleanings, x-rays and oral cancer treatment don’t affect this discount). You’ll need to contact the insurer directly to find out about prices.

Since AXA has such a wide network of partners you’ll also benefit from special offers on things like gym memberships, leisure activities, and other areas of healthcare.

Simplyhealth

The UK’s leading health cash plan provider has almost 3.5 million registered customers and has been operating for more than 140 years. All of the four dental care plans from Simplyhealth cover private treatment, with varying benefit levels.

Boots

This high street name has been in business for over 160 years and now offers three levels of dental insurance for both NHS and private care.

Its private dental care plans reimburse a fixed amount for each type of treatment, for example £20 for a routine checkup and £41 for a surgical extraction (usually required for wisdom teeth). This may or may not come close to actual costs, depending on what your dentist charges.

Their basic plan provides immediate cover for emergency treatment.

WPA

Western Provident Association (WPA) is a UK-based health insurer with over 110 years behind them. They place a strong emphasis on charitable work and supporting projects in the UK that promote good health.

WPA’s NHS-only cover is relatively expensive but they will reimburse 100% of your costs with no upper limit – much more generous when compared to other dental health plans in the UK which only pay for one treatment per year in each category. Their second tier of WPA dental insurance also covers private work, but with comparatively low annual limits.

Denplan

Denplan, also underwritten by AXA, has recently re-branded as part of Simplyhealth professionals. Denplan is a capitation plan provider, which means you’ll get a quote directly from your dentist and will be tied to that practice. There is the option to purchase supplementary insurance which makes some provision for emergency treatment, even if you’re away from home.

Some practices allow you to sign up online, but most require a visit in person so they can assess your current oral health and provide a personal quote. Around half of all dental practices in the UK are Denplan members.

There are no standard costs as your dentist is free to set their own price based on how much treatment they think you will need, plus there are different levels of cover available. As a rough guide, Denplan costs between £13 and £22 per month for the average patient, including cover for fillings and extractions.

If you want dental implant insurance in the UK, with Denplan you can pay an extra monthly premium to receive £20,000 of insurance cover for dental implants.

Best dental insurance in the UK – comparison tables

Now it’s time to compare dental insurance policies in the UK from the providers mentioned.

Let’s first look at NHS dental plans available from some of the best dental insurance companies in the UK. These plans apply to NHS-approved treatment at an NHS dentist, but not private treatment:

Insurer | Boots Core Plan | Dencover NHS | WPA Level One |

Annual fee | From £137.64 | From £72.00 | From £132.60 |

Below are the maximum amounts that may be claimed per year, and the percentage of the total cost that will be reimbursed. | |||

Checkups, x-rays, scale & polish / hygienist | 100% reimbursed, £500 limit across all routine treatments | £22.70 / 100% | 100% of all costs |

Fillings, extractions, root canals, dentures, crowns, bridges | 100% reimbursed, £500 limit across all routine treatments | £124.20 / 100% | 100% of all costs |

Accident (essential treatment following an accident or injury) | 100% reimbursed, £500 limit across all emergency treatments, NHS only | £2,500 / 100% (worldwide) | £10,000 (NHS or private, reimbursement limits for each treatment, worldwide up to 35 days per year) |

Emergency (when urgent pain relief is needed) | 100% reimbursed, £500 limit across all emergency treatments, NHS only | £425 / 100% (worldwide) | £500 / 75% (NHS or private, maximum £250 per visit and two visits per year, worldwide up to 35 days per year) |

Oral cancer | Not covered | £2,500 / 100% | £10,000 (NHS or private, reimbursement limits for each treatment) |

Hospital stay | £100 per night, up to £5,000 | Not covered | £200 per night, up to £2,000 |

Waiting period | Immediate for emergency, 3 months for everything else | Immediate for checkups and cleaning, 15 - 60 days for everything else | 14 days for accident & emergency, 1-3 months for everything else |

If visiting an NHS dentist isn’t an option for you, or you would prefer private treatment, you’ll need to look at full dental coverage plans. As we’ve said before, these do vary in price according to a number of factors.

We can’t include all dental insurance plans from all providers here, but the following table compares mid-range policies from several of the main providers to give you an idea of private dental insurance costs in the UK. You’ll need to contact the provider directly to see their full range of dental payment plans and check what conditions apply.

Insurer | Simplyhealth Level 2 | Boots Private Level 1 | WPA |

Annual fee | £191.04 | From £201.24 | From £188.76 |

Below are the maximum amounts that may be claimed per year, and the percentage of the total cost that will be reimbursed. | |||

Checkups and x-rays | £75 / 100% | Fixed amount for each treatment, £750 limit across all treatments | 75% / £250 limit across all routine treatments |

Scale & polish / hygienist | £65 / 75% | Fixed amount for each treatment, £750 limit across all treatments | 75% / £250 limit across all routine treatments |

Fillings, extractions, root canals, dentures, crowns, bridges | £400 / 50% | Fixed amount for each treatment, £750 limit across all treatments | 75% / £250 limit across all routine treatments |

Accident (essential treatment following an accident or injury) | £5,000 / 100% (worldwide for up to 28 days per year) | £1,000 / 100% (worldwide after 6 months of cover) | £20,000 (NHS or private, reimbursement limits for each treatment, worldwide up to 35 days per year) |

Emergency (when urgent pain relief is needed) | £500 / 100% (worldwide for up to 28 days per year) | Fixed amount for each treatment, £750 limit across all treatments | £1,000 / 75% (NHS or private, maximum £250 per visit and four visits per year, worldwide up to 35 days per year) |

Oral cancer | £5,000 one-off single payment | £5,000 one-off single payment | £10,000 (NHS or private, reimbursement limits for each treatment) |

Hospital stay | £50 per night, up to 20 nights | £100 per night, up to £5,000 | £200 per night, up to £2,000 |

Waiting period | Immediate for checkups and cleaning, 3 months for everything else | Immediate for emergency, 6 months for oral cancer, 3 months for everything else | 14 days for accident & emergency, 1-3 months for everything else |

All details are correct as of February 2024 but insurers may update their policies at any time.

Tips for getting the best price on dental insurance

Whether you’re choosing between insurance providers or dental clinics, costs vary wildly. It’s therefore well worth doing a dental insurance comparison of your own to assess different options. Try to get quotes from two or three providers so you can be sure you’re getting a good deal. Make sure you are comparing like for like, since there are so many variations in levels of cover.

Once you have settled on a plan you’re happy with, double-check the small print to be sure it covers everything you need.

Also consider how much of an excess you are prepared to pay, if your insurer offers this as an option. As with car insurance, a higher excess will mean lower premiums, but you’ll have to fork out more whenever you make a claim. If you opt for a high excess – which may make sense if you want it mainly for emergency cover – set that amount aside in a savings account, just in case.

Paying for your insurance

It’s normal to pay an annual insurance premium for your private dental plan and, just like any other insurance, it can increase or decrease from year to year. Some providers offer a no-claims discount with their policies.

Many providers offer monthly payment options for customers who can’t afford a lump sum payment. If you decide to spread the cost over the year, try to find a 0% interest deal so you don’t end up paying any more for your cover.

If you’re faced with a price hike when your insurance renews, don’t just accept it straight away. Call your provider to see if they can give a more competitive rate, and again compare their offer with other policies on the market. Don’t be afraid to switch if you find a better deal elsewhere.

Things to check first

Before you commit to anything, check that you’re not covered elsewhere. Some employers provide medical insurance as a benefit to employees, and that may include some level of dental health care. Even credit cards can throw in health cover as an incentive to new customers.

If you do find that you already have dental cover under another policy, be sure to check it carefully to ensure the levels of cover are sufficient for your situation; if not, you may still want to take out your own private dental insurance.

And we’ve said it already but it’s worth repeating: check and double-check the small print of your policy so you know exactly what you are and are not covered for.

Affordable dental care without insurance

If you need private dental care and insurance isn’t an option, ask your dentist if they offer dental payment plans. This finance is a like a loan for your dental fees, letting you spread the cost over a number of months or even years.

You might be able to arrange a plan directly with your dentist if you have a good relationship with them. Alternatively, they may refer you to a third-party finance provider. Since you’re essentially borrowing money, you may well have to pay interest on your treatment. Check the details of the agreement before you sign up, so you understand exactly what is involved.

Similarly, you could arrange a dental loan or use a credit card to fund your treatment.

These options won’t actually reduce the amount you have to pay, but they do make it easier to manage the payments. This can be especially helpful for expensive treatments like implants and orthodontic work.

Finally, you could consider dental tourism – travelling abroad to access cheaper dental care. This can be particularly cost-effective if you need dental implants.

Chat with a dentist

Do you have questions about dental treatment? Visit JustAnswer to chat online with a qualified dentist and find out all the information you need – without having to take time out for a dental appointment. Their dentists are based in the US but are available 24/7 to help you out.

FAQ’s

What is the best dental insurance plan UK?

Each dental insurance plan has unique features, so its important to explore our comparison table to figure out which provider has the best dental insurance plan for you.

What is the cost of cost of private dental insurance?

UK dental insurance costs about £10 per month on average, but can range up to £50 per month, influenced by factors like dental history, age, gender, coverage level, and location. The choice between NHS or private treatment also affects the overall expense.

Is dental insurance worth it UK?

Dental insurance in the UK is optional, thanks to subsidised care. While NHS offers some coverage, private dental insurance may be chosen for reasons like location, past experiences, specific treatments, or frequent dental needs. Assess your situation for the best decision.

How does dental insurance work UK?

In the UK, dental insurance involves paying a monthly premium. The insurer then contributes towards your dental costs, covering check-ups and treatments. Policy specifics, such as coverage level and limitations, affect the reimbursement amount.

What is the best dental plans for seniors UK?

For the best dental plan for seniors in the UK, check out or comparison table earlier in this article. Private dental insurance can offer additional benefits and these dental plans can be tailored to your individual needs, but before you do this make sure you are aware of the level of dental treatment that is accessible to you through the NHS.

NHS (National Health Service) https://www.nhs.uk/common-health-questions/dental-health/which-dental-treatments-are-available-on-the-nhs/ Consulted 24th April 2019.